It is important for students to understand the core subjects covered in the program. Knowing what you will study helps in aligning your career goals and preparing for professional opportunities. The online mode of learning has further made B.Com Honours accessible to students across the country without compromising on academic rigour or industry relevance.

Table of Contents

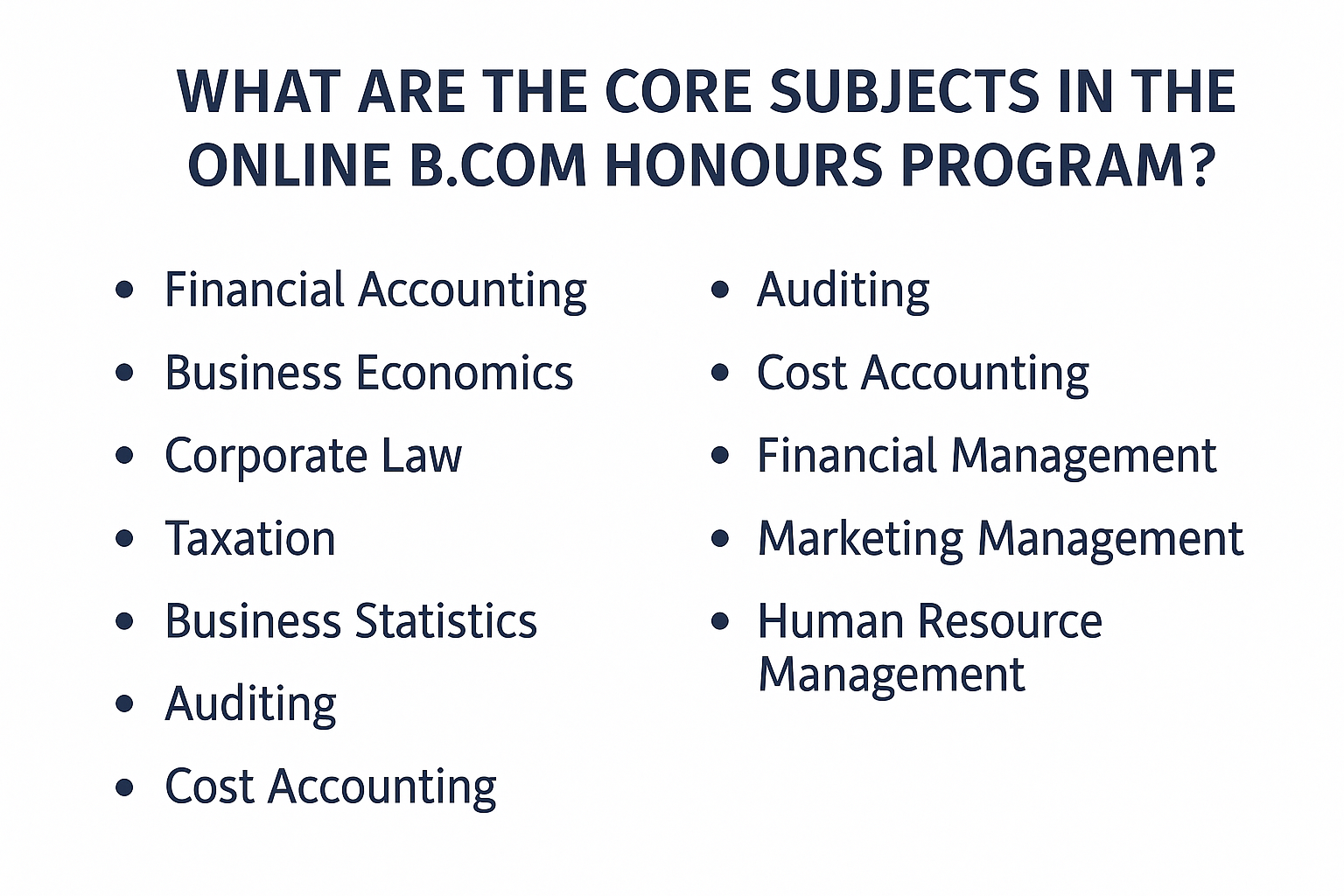

Core Subjects in Online B.Com Honours

1. Financial Accounting

Students will learn the fundamental principles of accounting, including how to maintain accurate financial records, prepare balance sheets, income statements, and cash flow statements. The subject emphasises the interpretation of financial data to support business decision-making and the application of accounting standards in real-world scenarios.

Skills:

-

Analytical Thinking

Students will develop the ability to examine financial statements thoroughly, identify trends, and detect irregularities, enabling them to make informed business decisions.

-

Attention to Detail

Handling financial records requires meticulous attention, ensuring that all entries are accurate, complete, and compliant with regulatory standards.

-

Data Interpretation

Learners gain the capability to analyse numerical data to derive meaningful insights, which can inform budgeting, forecasting, and investment decisions.

-

Problem-Solving

Students will apply accounting principles to resolve practical business challenges, such as discrepancies in ledgers or optimising financial reporting processes.

Career Prospects:

Accountant

Accountants manage day-to-day financial operations, including preparing financial statements, maintaining ledgers, and ensuring accurate reporting for businesses of all sizes.

Auditor

Auditors examine and verify the correctness of financial records, identify risks, and ensure compliance with laws and accounting standards, playing a key role in maintaining organisational transparency.

Financial Analyst

These professionals analyse financial data to guide investment, budgeting, and corporate strategy decisions, helping businesses optimise performance and manage risks effectively.

Tax Consultant

Tax consultants provide expert advice on tax planning, compliance, and filing processes, assisting individuals and businesses in minimising liabilities while adhering to legal requirements.

Financial Accounting equips students with a solid understanding of business finances, critical thinking, and problem-solving skills, making them capable of managing and analysing financial data effectively in any professional environment.

2. Business Economics

This subject covers both micro and macroeconomic concepts, such as supply and demand, market structures, inflation, business cycles, and fiscal policies. Students learn to analyze market trends, assess economic impacts on businesses, and apply economic theories to real-world situations.

Skills:

-

Strategic Analysis

Students develop the ability to examine market behaviors, economic policies, and trends to forecast outcomes and make strategic business decisions.

-

Problem-Solving

Learners are trained to apply economic models to identify solutions for business challenges, such as pricing strategies, resource allocation, or market entry decisions.

-

Decision-Making

By interpreting economic data, students enhance their capacity to make informed choices regarding investments, operations, and policy planning.

-

Research Skills

Students gain expertise in collecting, analysing, and interpreting economic data, enabling them to support evidence-based decisions in corporate or policy environments.

Career Prospects:

Business Analyst

Professionals assess market trends, economic indicators, and business performance metrics to recommend strategies that improve efficiency and profitability.

Economist

Economists study economic data to forecast trends, advise organizations or governments, and contribute to policy development and strategic planning.

Policy Advisor

Policy advisors use economic insights to provide recommendations on regulations, taxation, and market policies for governmental or corporate clients.

Market Researcher

These specialists collect and analyze consumer and market data to help businesses understand demand, competitive landscape, and opportunities for growth.

Business Economics provides students with the tools to understand economic systems and their impact on businesses, fostering critical thinking and analytical skills essential for decision-making in professional and policy environments.

3. Corporate Law

Focuses on company regulations, business law, corporate governance, and compliance requirements. Students learn legal frameworks for corporate operations and the ethical obligations of businesses.

Skills:

-

Legal Awareness

Understanding of regulatory requirements and the ability to apply them in business scenarios.

-

Risk Assessment

Ability to identify legal risks in transactions and business strategies to ensure compliance.

-

Analytical Thinking

Evaluating laws, contracts, and policies to provide solutions to corporate legal challenges.

-

Problem-Solving

Applying legal principles to resolve issues like disputes, contract negotiations, and governance concerns.

Career Prospects:

Corporate Lawyer

Advises companies on legal matters, drafts contracts, and ensures adherence to corporate laws.

Compliance Officer

Monitors organisational practices to ensure they comply with internal policies and regulatory standards.

Legal Consultant

Provides guidance on business-related legal issues, contracts, and risk management.

Company Secretary

Ensures corporate governance standards are met and maintains statutory records.

Corporate Law equips students with legal knowledge and critical thinking skills, opening career paths in corporate legal services and compliance management.

4. Taxation

Introduces principles of direct and indirect taxation, GST, income tax laws, and tax planning. Students learn how taxes impact individuals and businesses, along with planning strategies for compliance.

Skills:

-

Numerical Accuracy

Calculating taxes correctly and preparing precise financial reports.

-

Logical Reasoning

Understanding complex tax laws and applying them effectively to varied scenarios.

-

Planning Abilities

Strategically planning tax-saving opportunities while adhering to legal requirements.

-

Analytical Thinking

Reviewing financial data to identify potential tax liabilities or optimisation options.

Career Prospects:

Tax Consultant

Provides advice on tax planning and compliance to minimize liabilities legally.

Financial Planner

Assists individuals and businesses in managing finances, including tax efficiency.

Auditor

Reviews financial statements to ensure tax compliance and accuracy.

Banking Sector Roles

Helps manage corporate or personal finance, including tax-related advisory services.

Taxation develops analytical, planning, and legal skills that are essential for financial advisory, auditing, and compliance careers.

5. Business Statistics

Covers statistical methods, probability, hypothesis testing, and forecasting for business decision-making. Students learn to interpret data and use statistical tools to solve business problems.

Skills:

-

Quantitative Analysis

Ability to process numerical data accurately for meaningful insights.

-

Data Interpretation

Understanding patterns and trends to inform strategic decisions.

-

Decision-Making

Using statistical results to guide business planning and operational strategies.

-

Problem-Solving

Applying statistical techniques to analyse real-world business challenges.

Career Prospects:

Data Analyst

Interprets business data to provide actionable insights for strategic decisions.

Business Analyst

Uses data to evaluate performance and recommend improvements.

Actuary

Assesses financial risks using statistical models for insurance or investment decisions.

Market Research Executive

Applies statistical methods to study consumer behaviour and market trends.

Business Statistics equips students with the ability to analyse and interpret data, making them valuable assets in data-driven business environments.

6. Auditing

Introduces principles, types, and procedures of auditing, including internal controls and compliance verification. Students learn how to systematically evaluate business operations and financial statements.

Skills:

-

Critical Evaluation

Assessing financial and operational records to ensure accuracy and compliance.

-

Ethical Decision-Making

Maintaining integrity while identifying discrepancies or fraudulent activities.

-

Risk Identification

Detecting potential risks in financial statements and operational processes.

-

Analytical Thinking

Interpreting audit findings to provide constructive recommendations.

Career Prospects:

Auditor

Conducts detailed examinations of financial statements for compliance and accuracy.

Internal Auditor

Monitors internal controls and operational processes to prevent errors and fraud.

Risk Analyst

Evaluates potential financial and operational risks and suggests mitigation strategies.

Assurance Services Professional

Provides credibility to financial information for stakeholders.

Auditing equips students with analytical and ethical skills essential for ensuring transparency and compliance in organisations.

7. Cost Accounting

Covers methods of costing, budgeting, variance analysis, and managerial decision-making. Students learn to control costs and make informed financial decisions within organisations.

Skills:

-

Cost Management

Planning and controlling expenses to maximise efficiency and profitability.

-

Problem-Solving

Identifying inefficiencies and implementing corrective measures to reduce costs.

-

Planning Efficiency

Using cost data to plan budgets and allocate resources effectively.

-

Analytical Thinking

Evaluating financial information to support strategic business decisions.

Career Prospects:

Cost Accountant

Manages and analyses cost structures to help organisations maintain profitability.

Budget Analyst

Prepares and monitors budgets to ensure financial targets are met.

Management Accountant

Provides reports and insights for strategic decision-making.

Operations Manager

Uses cost data to improve operational efficiency and reduce waste.

Cost Accounting helps students develop financial planning and analytical skills that are critical for management and operational roles.

8. Financial Management

Covers capital budgeting, working capital management, investment decisions, and corporate finance principles. Students learn strategies to optimize financial performance and ensure sustainable growth.

Skills:

-

Strategic Financial Planning

Formulating long-term financial plans for organisational growth.

-

Decision-Making

Making informed investment and financing decisions using financial data.

-

Analytical Reasoning

Interpreting financial metrics to assess organizational health.

-

Problem-Solving

Addressing financial challenges like liquidity management and risk mitigation.

Career Prospects:

Finance Manager

Oversees financial planning, reporting, and investment decisions for organisations.

Investment Banker

Advises clients on raising capital, mergers, and acquisitions.

Portfolio Manager

Manages investment portfolios and evaluates financial opportunities.

Financial Consultant

Provides financial advisory services to individuals or businesses.

Financial Management develops analytical and strategic skills, preparing students for leadership roles in finance and investment.

9. Marketing Management

Teaches fundamentals of marketing, including consumer behaviour, product development, pricing, promotion, and distribution strategies. Students learn to design and implement marketing campaigns effectively.

Skills:

-

Creativity

Developing innovative marketing strategies to engage customers and enhance brand value.

-

Communication

Conveying marketing messages effectively through various channels and media.

-

Negotiation

Building relationships with clients, suppliers, and stakeholders to achieve business goals.

-

Strategic Thinking

Planning campaigns based on market research, consumer behaviour, and competition analysis.

Career Prospects:

Marketing Executive

Implements marketing strategies to promote products and services.

Brand Manager

Develops and manages brand identity, positioning, and market presence.

Sales Manager

Oversees sales operations and develops strategies to increase revenue.

Digital Marketer

Leverages online platforms to run marketing campaigns and reach target audiences.

Marketing Management equips students with strategic and creative skills necessary to drive brand growth and customer engagement.

10. Human Resource Management

Covers recruitment, training, performance management, employee relations, and organisational behaviour. Students learn how to manage human capital to maximise productivity and employee satisfaction.

Skills:

-

People Management

Leading and motivating employees while addressing workplace challenges effectively.

-

Communication

Conveying ideas clearly and building positive workplace relationships.

-

Leadership

Guiding teams toward achieving organisational goals while fostering a collaborative culture.

-

Conflict Resolution

Identifying, mediating, and resolving conflicts to maintain a harmonious work environment.

Career Prospects:

HR Executive

Handles recruitment, training, and employee engagement initiatives.

Talent Acquisition Specialist

Manages the hiring process and identifies the best candidates for organisational needs.

Training Manager

Designs and implements programs to enhance employee skills and performance.

HR Consultant

Provides strategic advice on workforce management, policies, and organisational development.

Human Resource Management develops interpersonal and leadership skills, preparing students for dynamic roles in managing and nurturing organisational talent.

Online Learning Advantages

Online learning has transformed higher education, making quality programs like B.Com Honours accessible to students across India and beyond. By combining technology with a structured curriculum, online education allows learners to study at their own pace while gaining the same academic knowledge as traditional classroom programs.

Here are the key benefits of pursuing an Online B.Com Honours program:

-

Flexibility in Learning

Students can access course materials anytime and anywhere, allowing them to balance studies with work, internships, or personal commitments. This flexibility ensures that learning fits into diverse schedules without compromising quality.

-

Self-Paced Progression

Online platforms often allow learners to move through the syllabus at their own speed. Those who grasp concepts quickly can accelerate, while others can spend additional time on complex topics for better understanding.

-

Access to Digital Resources

Students benefit from a wide range of e-books, recorded lectures, case studies, and interactive modules, which enhance understanding and support the practical application of concepts.

-

Cost-Effectiveness

Online programs often have lower tuition and no commuting or accommodation costs, making high-quality education more affordable and accessible for a broader audience.

-

Enhanced Technical Skills

By interacting with digital learning platforms, students naturally develop computer literacy, virtual collaboration abilities, and familiarity with tools like spreadsheets, financial software, and online research databases.

-

Global Networking Opportunities

Virtual classrooms allow students to interact with peers and faculty from different regions and backgrounds, fostering diverse perspectives and professional networking opportunities.

-

Career-Oriented Approach

Many online programs integrate real-world case studies, virtual internships, and industry projects, ensuring students acquire practical knowledge and skills relevant to modern commerce roles.

Online learning for B.Com Honours students not only delivers academic content effectively but also nurtures self-discipline, digital literacy, and career readiness. This mode of education ensures that learners are equipped for professional challenges while enjoying flexibility and convenience in their studies.

Conclusion

The Online B.Com Honours program offers a well-rounded education through its core subjects. Each subject is designed to build specific knowledge, enhance skills, and open diverse career opportunities. By mastering these subjects, students are prepared not only for professional roles in commerce, finance, and management but also for higher studies such as MBA, M.Com, or professional certifications.

The program ensures that students receive a holistic foundation in commerce while enjoying the flexibility and convenience of remote learning. This combination of academic rigour and practical relevance makes it an ideal choice for commerce aspirants aiming to succeed in today’s competitive business environment.